Employment and Income Programs

WorkBC Centres

These are the local hubs for career information and job search help.

The WorkBC centres are the local hubs for career information and job search help.

Each centre provides résumé help and aid in job search. Free computer access, printing and faxing for job seeking only. Each centre has a catchment area. Find out which location to go to at their website or ask at your local library.

Also offers some great online career planning and aptitude quizzes.

WorkBC Centre Cloverdale

202 - 17700 56 Avenue, Surrey BC (get directions to Work BC Cloverdale)

778-547-5020

Learn about WorkBC Centre Cloverdale

WorkBC Centre Delta

310 - 11861 88th Avenue, Delta BC (get directions to Work BC Delta)

604-591-9116

Learn about WorkBC Centre Delta

WorkBC Centre Guildford

202 - 10334 152A Street, Surrey BC (get directions to Work BC Fleetwood/Guildford)

604-580-9740

Learn about WorkBC Centre Guildford

WorkBC Centre Newton

110 - 7525 King George Boulevard, Surrey BC (get directions to Work BC Newton)

778-728-0175

Learn about WorkBC Centre Newton

WorkBC Centre Whalley

160 - 10362 King George Boulevard, Surrey BC (get directions to Work BC Whalley)

604-584-0003

Learn about WorkBC Centre Whalley

WorkBC Centre White Rock/South Surrey

108 - 1688 152 Street, Surrey BC (get directions to Work BC White Rock/South Surrey)

604-531-3331

Learn about WorkBC Centre White Rock/South Surrey

Employment Programs

Find help deciding on a career, résumé assistance, loans to buy equipment, job training and more.

Active Generation for Employment (AGE) for Job Seekers Age 55+

245 - 10330 152nd Street, Surrey BC (get directions to Active Generation for Employment (AGE) for Job Seekers Age 55+)

778-394-8822

Helps workers over the age of 55. 3-week intensive office administration and customer service skills training. One-to-one job search coaching.

Learn more about Active Generation for Employment (AGE) for Job Seekers Age 55+.age-info@success.bc.ca

BARISTAS Training

201B - 10334 152A Street, Surrey BC (get directions to BARISTAS Training)

604-992-2133 baristas@pcrs.ca

Free program for youth ages 16-30 years old. Offers 3 certificates including Food Safe, Super Host and Serving It Right.

Learn more about BARISTAS Training.

BC Newcomer Services Program

150 - 10362 King George Blvd, Surrey, BC V3T 2W5 (get directions to BC Newcomer Services Program)

604-999-0625

Helps newcomers enter the job market and improve their language skills.

Learn more about BC Newcomer Services Program.

Career Paths for Skilled Immigrants

Helps immigrant professionals use their skills, training, and foreign qualifications. Find work that matches your experience and background.

Learn more about Career Paths for Skilled Immigrants

CAVE Youth Employment Program

Douglas College - Burnaby Training Centre: 202 - 4250 Kingsway Avenue, Burnaby BC (get directions to Douglas College)

604-438-3045

Program to help you identify job goals, explore careers, build workplace skills, and connect with local employers. For young adults (16-29).

Learn more about CAVE Youth Employment Program.

Coast Capital Credentialing Program for Newcomer Women

604-547-2275 ashahin@dcrs.ca

Connects you with a career navigator to help you update your foreign credentials. Also provides up to $2000 to cover exams or licensing fees. Must be under 30 years old, in Canada for less than 5 years, and be a protected person, or have PR or citizenship.

Learn more about Coast Capital Credentialing Program for Newcomer Women.

Diverse Entrepreneurs Business Incubator

604-547-1662 selfemployment@dcrs.ca

Provides important information, resources and advice for aspiring immigrant entrepreneurs. One-on-one consultations, referrals and workshops. Language support may be available in English, Mandarin, Arabic and Korean.

Learn more about Diverse Entrepreneurs Business Incubator.

EMBERS Staffing Solutions—Surrey Office

201 - 10595 King George Boulevard, Surrey BC (get directions to EMBERS Staffing Solutions)

778-293-0781 surrey@embersstaffing.com

EMBERS helps people find short and long-term jobs placements. Jobs in construction, hospitality, warehousing, and security. They offer support and chances to move up. Will provide needed gear like steel-toed boots and training.

Learn more about EMBERS Staffing Solutions.

Employment Programs @ PICS

205 - 12725 80th Avenue, Surrey BC (get directions to PICS)

604-596-7722

Wide range of employment programs. Includes a number of shorter term certificate programs designed to get people working.

Learn more about Employment Programs @ PICS.

Empowered for Employment

109 - 5577 153A Street, Surrey BC (get directions to Empowered for Employment)

604-262-4858 eeinfo@sourcesbc.ca

Free job programs help people get ready for and find work. Each program offers personalized planning and support. They include workshops on exploring careers and job search strategies. There is also short-term training, plus help with work experience and job placement.

Learn more about Empowered for Employment.

Fast Track to Manufacturing Plus

200A - 7134 King George Boulevard, Surrey BC (get directions to Fast Track to Manufacturing Plus)

604-351-9665 f2mplus@mosaicbc.org

Program for young newcomers (16 to 29 years old) to learn about careers in manufacturing and trades. Paid training and workshops, certificates, and help developing a career path. 3 weeks of paid employment readiness workshops. 3 weeks of paid technical skills training. Gain first aid, WHMIS and other certificates. Will help you develop a personalized career path plan.

Learn more about Fast Track to Manufacturing Plus.

Foreign Credential Recognition Program

205 - 12725 80th Avenue, Surrey BC (get directions to the Foreign Credential Recognition Program)

604-596-7722 Ext: 157

Helps internationally trained professionals reenter their profession or a related field. Offers a loan amount up to $30,000, to cover the cost of credentialing. Flexible repayment schedule. Also has a range of supports to help you in your career, including things like career advising and resume support.

Learn more about Foreign Credential Recognition Program.

Foundry Work & Education Program

info@foundrybc.ca

Free supported program for youth ages 15-24. Offers support and guidance in navigating the sometimes overwhelming decisions. Can help if you are interested in working, going to school, or completing training. Program can be accessed virtually, or in-person at Foundry centres across BC.

Learn more about Foundry Work & Education Program.

Future Leaders

202 - 10070 King George Boulevard, Surrey BC (get directions to Future Leaders)

604-597-0205 youthjobs@dcrs.ca

Free, innovative youth employment program that will set you up for career success. Explore different job options. Improve your resume and interview preparation skills. Get one on one coaching and mentorship. For permanent residents, Canadian citizens and protected persons aged 15–30.

Learn more about Future Leaders.

Future Troopers

202 - 10070 King George Boulevard, Surrey BC (get directions to Future Troopers)

604-597-0205 youthjobs@dcrs.ca

Employment specialists will aid you in the course you want to take. Will help you find a job. Receive the skills training. Earn the Canadian employer-recognized certification you need. Also offers support with transportation, work clothes, and tools for the job. For youth 17-29, Canadian citizens or permanent residents, unemployed or underemployed.

Learn more about Future Troopers.

H.E.A.L. Work Program for Women

604-547-1260 heal@dcrs.ca

Program empowers survivors of violence to get into the labour market. Offers tuition fee support and occupational skills training. Gain paid work experience. Childcare supports are available and individual counselling. Up to $1,000 in completion bonuses. Program open to survivors of violence or trauma, who are experiencing health issues like stress, depression, or anxiety. Must be unemployed or working less than 20 hours per week. Must also be a permanent resident or Canadian citizen.

Learn more about H.E.A.L. Work Program for Women.

La Boussole

312 Main St, Vancouver BC (get directions to La Boussole)

604-683-7337

Centre Communautaire Francophone qui aide des gens qui parlent Français qui font face à des situations difficiles. Offre une variété de programmes sociaux et d'aide à l'emploi. French speaking community centre that helps French speakers facing difficult situations. Offers a variety of programs.

Learn more about La Boussole.

Neil Squire Society

400 - 3999 Henning Drive, Burnaby BC (get directions to the Neil Squire Society)

604-473-9363

Offer a range of services for individuals with disabilities. Can help you build digital skills, or find assistive technology solutions that work for you. Have programs around finding employment and building job skills.

Learn more about Neil Squire Society.

Newcomer Employment Support Program

150 - 10362 King George Boulevard, Surrey BC (get directions to the Newcomer Employment Support Program)

604-954-0483

Help for newcomers looking for work who live in Surrey and Delta. Have individual coaching, resume help, job fairs and mentorship. Services are available in person and virtual. Services offered in Arabic, Hindi, Korean, Punjabi, Tagalog, Dari, Pashto, Farsi, Urdu, Ukrainian and English.

Learn more about Newcomer Employment Support Program.

S.A.H.A.R.A. Program for Men

604-547-1260 sahara@dcrs.ca

Helps men facing multiple barriers find their place in the labour market. Gain new skills and work experience to build the life you want in Canada. Program provides a supported employment approach. Program is for racialized men who are unemployed or working less than 20 hours per week. Must be Canadian citizens, permanent residents or protected persons entitled to work in Canada. Designed for men with barriers like health, anxiety, depression or addiction issues. A criminal record or the lack of basic education and skills to obtain employment.

Learn more about S.A.H.A.R.A. Program for Men.

Safe Haven

604-597-0205 safehaven@dcrs.ca

Offers support to refugee claimants and other humanitarian newcomers. Offers a wide range of help with housing, finding work, and learning English. Also has access to counselling services. 2SLGBTQI+ support.

Learn more about Safe Haven.

SEED Youth Employment Program

13769 - 104th Avenue, Surrey BC (get directions to the SEED Youth Employment Program)

604-587-6634 seedyouth@douglascollege.ca

Program to help unemployed youth 16 to 30 years old find and keep a full-time job. Can help build work experience. Learn pre-employment skills, get short-term occupational certificate training and receive job search strategies and support. Includes 6 weeks of paid online classroom training and 8 weeks of work experience with an employer.

Learn more about SEED Youth Employment Program.

Self-employment Programs @ ISSofBC

301 - 10334 152A Street, Surrey BC (get directions to ISSofBC)

604-683-1684 sparkandignite@issbc.org

Range of self-employment programs for permanent residents, refugees, protected persons, and live-in caregivers or temporary foreign workers. Learn about business plans, and build your skills.

Learn more about Self-employment Programs @ ISSofBC.

Surrey Intercultural Youth Service Corps Project

12725 80th Avenue, Surrey BC (get directions to the Surrey Intercultural Youth Service Corps Project)

604-596-7722 siyscorps@pics.bc.ca

Provide valuable leadership training, community engagement skills and volunteer placements, so that youth can build community connections and prepare to enter into the work force.

Learn more about Surrey Intercultural Youth Service Corps Project.

This Way Onward

236-888-4756 thiswayonward@pcrs.ca

This employment service supports youth 16-24 to gain customer service skills through a series of workshops and a paid internship with Old Navy.

Learn more about This Way Onward.

Warehousing Program at Back In Motion

110 - 6651 Elmbridge Way, Richmond BC (get directions to Back In Motion)

604-273-7350

A unique opportunity for individuals with disabilities, who are interested in working in warehousing. Get an in-depth view of potential job tasks in a live simulated warehouse environment.

Learn more about Warehousing Program at Back In Motion.

Youth Career and Business Builders

604-596-7722, ext. 160 & 162 careerbuilders@pics.bc.ca

The Program is designed to support youth (16-29 years) over the weeks by exploring different programs, taking assessments, and ultimately choosing a career path in developing and implementing an Occupational Training Plan and successfully completing the training and certification required to attain meaningful, sustainable employment or training.

Learn more about Youth Career and Business Builders.

Youth Trade Builders Program by PICS

Unit 205, 12725- 80th Ave Surrey BC (get directions to PICS)

604-596-7722 ext: 150

Program for people aged 16-29 who are interested in the building trades. Program that explores different technical occupations. Will help you develop essential skills and safety training.

Learn more about the Youth Trade Builders Program.

Youth Works

604-591-9262, ext. 117 youthworks@bgcbc.ca

4 weeks of online group-based workshops and certificate training followed by a 6-week work experience placement with a local employer. Wage paid during training and work placement. For people 15 to 30 years old.

Learn more about Youth Works.

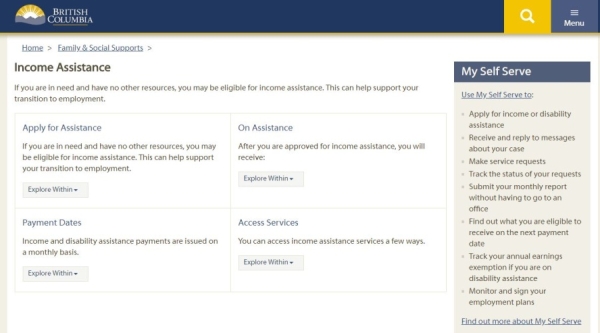

Income Supports

Learn about pension programs, help with income assistance or disability applications, rent supports and more.

In person help is available at the two locations below for Service Canada programs.

Service Canada North Surrey

13889 104th Avenue, Surrey BC (get directions to Services Canada North Surrey)

Service Canada South Surrey

103 - 15295 Highway 10, Surrey BC (get directions to Services Canada South Surrey)

Askanadvocate.ca by SOURCES

Provides basic and clear information about income assistance, disability benefits (provincial and federal), tenancy, and other income supports. Has videos, FAQs, fact sheets, and links to other services and resources.

Learn more about Ask An Advocate by Sources.

The Benefits Finder

Online tool helps find what government benefits you are eligible for.

Learn more about the Benefits Finder.

Canada Pension Plan (CPP) & Survivor Benefits(Service Canada)

1-800-277-9914

The Canada Pension Plan (CPP) Retirement Pension provides a monthly taxable benefit to retired contributors.

Learn more about the Canada Pension Plan (CPP) & Survivor Benefits(Service Canada).

Credit Counselling Society of BC

201 - 15399 102A Avenue, Surrey BC (get directions to the Credit Counselling Society of BC)

604-527-8999

Non-profit service helping people from all walks of life manage their money and debt better. No walk-ins, call for appointment.

Learn more about the Credit Counselling Society of BC.

Debtors Anonymous

604-878-3328

A group meeting for people dealing with compulsive debt. Gather to share experiences, strengths and hopes and work to solve common problems and help others recover.

Learn more about Debtors Anonymous.

Disability Alliance BC

1450 - 605 Robson Street, Vancouver BC (get directions to the Disability Alliance BC)

604-875-0188 (Advocacy Access Line) 236-427-1108 (Disability Law Clinic)

Provides a range of services and programs for people with disabilities. Can help with apply for disability benefits and appeal if you are denied. Also offers a law clinic and a variety of workshops. Offers remote services and are slowly beginning to offer in-person assistance. Please call the advocacy access line for the most current information about office re-opening.

Learn more about the Disability Alliance BC.

Employment Insurance Regular Benefits

1-800-206-7218

Employment Insurance (EI) provides regular benefits to individuals who lose their jobs through no fault of their own (for example, due to a shortage of work, seasonal or mass lay-offs) and are available for and able to work, but can't find a job. Always apply for EI benefits as soon as you stop working. You can apply for benefits even if you have not yet received your Record of Employment (ROE). If you delay filing your claim for benefits for more than four weeks after your last day of work, you may lose benefits.

Learn more about Employment Insurance Regular Benefits.

Employment Insurance Sickness Benefits

1-800-206-7218

Employment Insurance (EI) sickness benefits can provide you with up to 15 weeks of financial assistance if you cannot work for medical reasons. You could receive 55% of your earnings up to a maximum of $573 a week.

Learn more about Employment Insurance Sickness Benefits.

Guaranteed Income supplement (Service Canada)

1-800-277-9914

The Guaranteed Income Supplement provides additional money, on top of the Old Age Security pension, to low-income seniors living in Canada. To be eligible for the GIS benefit, must be receiving the Old Age Security pension and meet the income requirements. Service also available through Service Canada Centre's.

Learn more about the Guaranteed Income supplement (Service Canada).

Last Post Fund

1-800-465-7113

Helps pay funeral and burial expenses for qualifying service members with the Canadian Military. Also can provide grave markers.

Learn more about the Last Post Fund.

Old Age Security Pension & Survivor Allowance (Service Canada)

1-800-277-9914

The Old Age Security pension is a monthly payment available to most Canadians aged 65+. You must apply to receive benefits. The Survivor Allowance is federal income benefit for low-income seniors who are 60 to 64 and whose spouse is collecting OAS and GIS or whose spouse has died. Must also meet legal and residency requirements.

Learn more about the Old Age Security Pension & Survivor Allowance (Service Canada).

Registered Disability Savings Plan

1-800-959-8281

A registered disability savings plan (RDSP) is a savings plan to help parents and others save for the long term financial security of a person who is eligible for the disability tax credit (DTC).

Learn more about the Registered Disability Savings Plan.

Rental Assistance Program

604-433-2218

Provides eligible low-income, working families help with their rent. To qualify, families must have a gross household income of $40,000 or less, at least one dependent child, and employed at some point over the last year.

Learn more about the Rental Assistance Program.

SAFER (Shelter Aid for Elderly Renters)

604-433-2218

Helps make rents affordable for BC seniors with low to moderate incomes. Provides monthly payments to subsidize rents for eligible BC residents who are age 60 or over and who pay rent for their homes.

Learn more about the SAFER (Shelter Aid for Elderly Renters).

SOURCES Newton Resource Centre

102 - 13771 72A Avenue, Surrey BC (get directions to the SOURCES Newton Resource Centre)

778-731-9195 www.askanadvocate.ca

Wide range of supports, information and advocacy for income assistance, disability, housing and federal income assistance programs. Can also help with housing issues, including looking for housing, and with the SOURCES Rent Bank. There is also a SOURCES Pro-Bono legal clinic.

Learn more about the SOURCES Newton Resource Centre.

Child Care

Learn about funding available to help pay for child care.

Affordable Child Care Benefit

Monthly payment to help eligible families with the cost of child care. Factors like income, family size, and type of care determine how much support families can get. You can find the application forms online. There is also an online calculator to estimate your funding. Funding goes directly the daycare provider to offset your cost.

Learn more about the Affordable Child Care Benefit.

Child Care Options Resource & Referral Program

100 - 6846 King George Boulevard, Surrey BC (get directions to the Child Care Options Resource and Referral Program)

604-572-8032 childcareoptions@options.bc.ca

Connects families and child care providers in Delta, Surrey and White Rock. Provides support, referrals, and assistance with the Affordable Child Care Benefit applications. You can also access a lending library. Offers workshops and programs for both parents and the child care providers.

Learn more about the Child Care Options Resource & Referral Program.

Tax Benefits & Income Tax Clinics

Learn about income tax clinics and some of the tax programs that you may benefit from.

It is worth filing income tax, especially for lower income people. You can only get these benefits if you qualify and file income tax yearly.

Tax Benefits

B.C. Renter's Tax Credit

1-800-959-828

Renter's tax credit based on annual income. This tax credit gives $400 to low- and moderate-income renter individuals and families with an adjusted income of $60,000 or less. Individuals and families with an adjusted income greater than $60,000 and less than $80,000 may receive a reduced amount.

Learn more about the B.C. Renter's Tax Credit.

Canada Child Benefit (CCB)

1-800-387-1193

Canada Child Tax Benefit is a tax-free monthly payment made to eligible families to help them with the cost of raising children under age 18. Additional benefits for children with a disability.

Learn more about the Canada Child Benefit (CCB).

Child and Family Tax Benefits Information

Website covers the provincial and federal tax benefits for children and families.

Learn more about the Child and Family Tax Benefits Information.

GST/HST Credit

GST/HST Credit program issues payments to Canadians with low and modest incomes. Helps offset all or part of the GST/HST they pay on goods and services. Assessment based on filed tax return, those eligible are contacted; if you have a spouse or common law partner, only 1 receives the credit.

Learn more about the GST/HST Credit.

Income Tax Clinics at Surrey Libraries

Who’s eligible?

Residents of Canada for tax purposes (living in Surrey, Langley, Delta and White Rock) with a modest family income of $35,000 for one person, to $52,500 for more than five people.

+ Investment income less than $1,000. No business or rental income, self-employment income, capital gains or losses, bankruptcy or deceased person filings.

Surrey Libraries - City Centre Branch

10350 University Drive, Surrey, BC V3T 4B8 (get directions to Surrey Libraries - City Centre Branch)

volunteer@dcrs.ca

Wednesdays, 10–2pm

March 19, 26 & April 2, 9, 16, 2025

By appointment: Book a tax clinic appointment at a library branch.

Surrey Libraries - Guildford Branch

15105 105 Avenue, Surrey, BC V3R 7G8 (get directions to Surrey Libraries - Guildford Branch)

volunteer@dcrs.ca

Thursdays, 10–2pm

March 6, 13, 20, 27, 2025

By appointment: Book a tax clinic appointment at a library branch.

Surrey Libraries - Strawberry Hill Branch

7399 122 Street, Surrey, BC V3W 5J2 (get directions to Surrey Libraries - Strawberry Hill Branch)

volunteer@dcrs.ca

Tuesdays, 10–2pm

March 4 & April 8, 2025

By appointment: Book a tax clinic appointment at a library branch.

Surrey Libraries - Clayton Branch

7155 187A Street, Surrey, BC V4N 6L9 (get directions to Surrey Libraries - Clayton Branch)

volunteer@dcrs.ca

Tuesdays, 10–2pm

March 11 & 18, 2025

By appointment: Book a tax clinic appointment at a library branch.

Other Tax Clinics in Surrey

You can find a complete listing of free Income Tax Clinics on the federal government's website.

Brella Income Tax Clinic (For Seniors only)

15008 26 Avenue, Surrey BC (get directions to the Income Tax Clinic at Brella)

604-531-9400 ext. 216

Free seniors tax clinic. Appointments required for in-person, drop-offs, or telephone services.

Learn more about Brella Income Tax Clinic (For Seniors only).

DIVERSEcity Income Tax Clinic

13455 76 Avenue, Surrey, BC V3W 2W3 (get directions to DIVERSEcity Income Tax Clinic)

volunteer@dcrs.ca

February 24, 2025, to April 16, 2025

Mondays (various times in the afternoon):

February 24, March 3, 10, 17, 24, April 7, 14, 2025

By appointment: Book a tax clinic appointment at DIVERSEcity.

Learn more about DIVERSEcity Income Tax Clinic.

Fraser Valley Taiwanese Society Tax Clinic

2845 156 Street Surrey, BC V3Z3Y3 (get directions to the Fraser valley Taiwanese Society Clinic)

604-598-9367

fraservalleytaiwanese@gmail.com

February 17, 2025, to December 31, 2025

By appointment, drop-off, virtual.

Muslim Community Care Tax Clinic

203-12837 76 Ave, Surrey, BC V3W2V3 (get directions to the Muslim Community Care Tax Clinic)

604-716-2558

info@muslimcommunitycare.org

January 1, 2025, to December 31, 2025

Walk-in, virtual, drop-off, by appointment

Languages: English, Arabic, Hindi, Urdu

Learn more about Muslim Community Care Tax Clinic.

Peace Portal Tax Clinic

15128 27B Ave, Surrey, BC V4P1P2 (get directions to the Peace Portal Tax Clinic)

236-988-4333

taxclinic@peaceportalalliance.com

March 1, 2025, to April 30, 2025

Walk-in, virtual, by appointment

Languages: English, Cantonese, Mandarin, Punjabi.

Learn more about Peace Portal Tax Clinic.

PICS Tax Clinic

205-12725 80 Ave, Surrey, BC V3W3A6 (get directions to PICS Tax Clinic)

604-596-7722 Ext: 104 kanika.mehra@pics.bc.ca satbir.cheema@pics.bc.ca

March 3, 2025, to April 30, 2025

Walk-in, drop-off, by appointment.

Languages: English, Arabic, Dari, Hindi, Pashto, Punjabi, Ukrainian

Learn more about PICS Tax Clinic.

Sources Newton Office Tax Clinic

#102-13771 72A Ave, Surrey BC V3W9C6 (get directions to Sources Newton Office Tax Clinic)

604-542-4357 volunteertaxclinic@sourcesbc.ca

February 24, 2025, to May 30, 2025

By appointment, drop-off

Languages: English, Dari, Hindi, Mandarin, Pashto, Punjabi, Romanian, Spanish, Ukrainian

Learn more about Sources Newton Office Tax Clinic.

Surrey Alliance Tax Service

13474 96 Ave Surrey, BC V3V1Y9 (get directions to the Surrey Alliance Tax Service)

778-808-5782 dnjpoole@shaw.ca

March 1, 2025, to April 30, 2025

By appointment, drop-off, virtual.

Learn more about Surrey Alliance Tax Service.

Surrey Chinese Baptist Church Tax Clinic

8590 160 St, Surrey, BC V4N 1A7 (get directions to the Surrey Chinese Baptist Church Tax Clinic)

March 23, April 13, 20, 27

1:00 PM – 4:30 PM

taxclinic@surreychinesebaptist.ca

Book an appointment at the Surrey Chinese Baptist Church Tax Clinic.

Learn more about Surrey Chinese Baptist Church Tax Clinic.

Surrey Urban Mission Tax Clinic

13545 King George Blvd, Surrey, BC V3T2V1 (get directions to the Surrey Urban Mission Tax Clinic)

778-887-2835 nathan@sumsplace.ca evelyn.schellenberg@sumsplace.ca

January 1, 2025 to December 31, 2025

Walk-in, virtual

Learn more about Surrey Urban Mission Tax Clinic.

Umoja Operation Compassion Tax Clinic

208-14888 104 Ave, Surrey, BC V3R1M4 (get directions to the Umoja Compassion Tax Clinic)

236-514-2935 snoithongkham@umojaoperation.ca madgoi@umojaoperation.ca

March 7, 2025, to April 25, 2025

Walk-in, drop-off, by appointment

Languages: English, Amharic, Arabic, Tigrinya

Learn more about Umoja Operation Compassion Tax Clinic.

Income Assistance Offices

Find your local income assistance office.

Fleetwood Office:

101 - 16088 84 Avenue, Surrey BC (get directions to the Fleetwood Income Assistance Office)

Park Place Office:

130 - 13749 72 Avenue, Surrey BC (get directions to the Park Place Income Assistance Office)

North Surrey Office:

100 - 13650 102 Avenue, Surrey BC (get directions to the Surrey-North Income Assistance Office)

Looking for services not covered here?

Please ask at your local library. We are here to help.

You can also call 211 for a free, confidential, multilingual information and referral line to a full range of community, social, and government services. Available 24 hours a day, 7 days a week.

If you would like further information or if you spot a change that is needed you can contact us.

Surrey Libraries does not endorse or promote particular resources or programs, and inclusion here does not imply the Library’s endorsement.